From ApartmentList.com: Apartment List National Rent Report

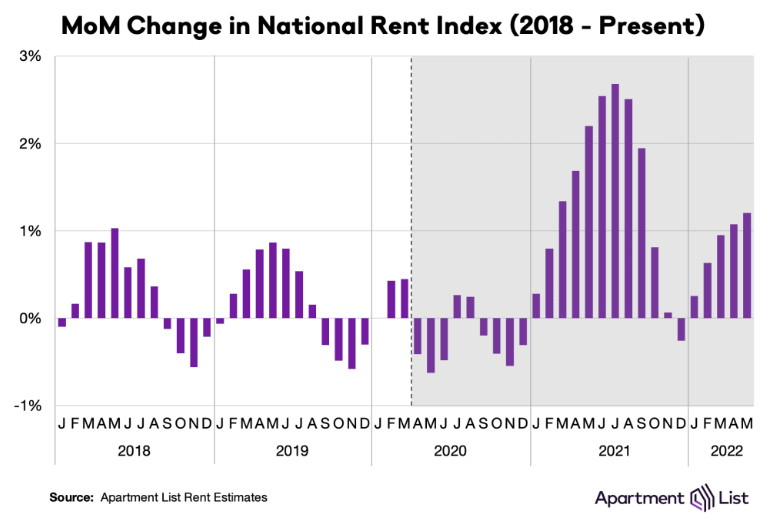

Welcome to the June 2022 Apartment List National Rent Report. Rent growth accelerated slightly again this month, with our national index up by 1.2 percent over the course of May. So far this year, rents are growing more slowly than they did in 2021, but faster than the growth we observed in the years immediately preceding the pandemic. Over the first five months of 2022, rents have increased by a total of 3.9 percent, compared to an increase of 6.1 percent over the same months of 2021. Year-over-year rent growth currently stands at a staggering 15.3 percent, but is down slightly from a peak of 17.8 percent at the start of the year.

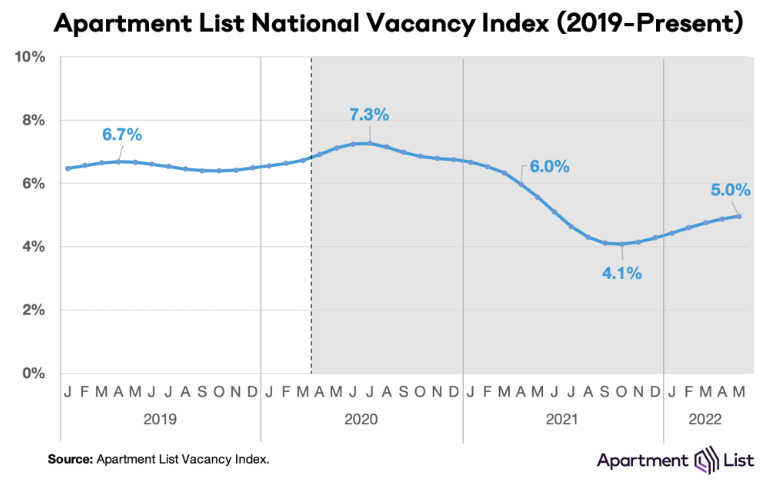

On the supply side, our national vacancy index ticked up slightly again this month, continuing a streak of gradual easing dating back to last fall. Our vacancy index now stands at 5 percent, up from a low of 4.1 percent, but remains well below the pre-pandemic norm. Rents increased this month in 96 of the nation’s 100 largest cities, though 70 of these cities have seen slower rent growth in 2022 so far than they did last year, and some of the hottest Sun Belt markets are finally showing signs of plateauing growth.

emphasis added

Rents are still increasing sharply, but not as rapidly as a year ago.

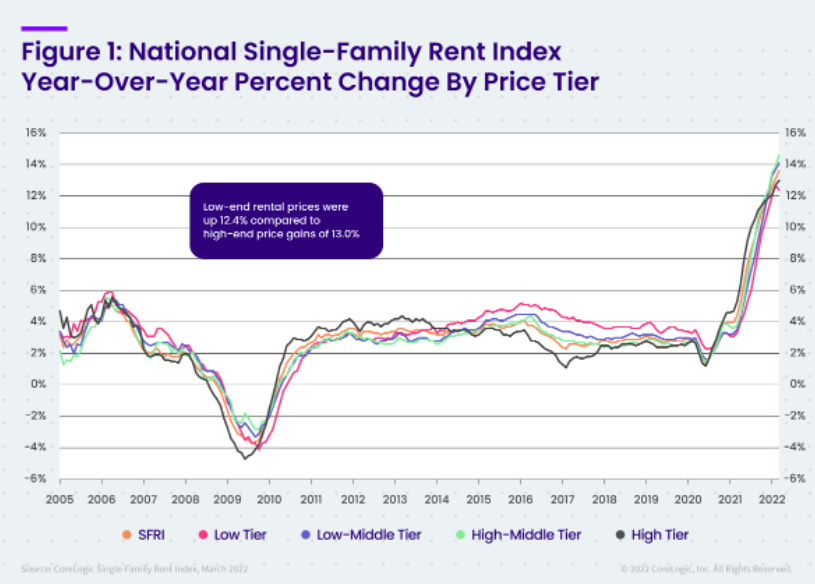

CoreLogic also tracks rents for single family homes: Annual Rent Growth Hits One-Year Record High in March, CoreLogic Reports

CoreLogic … today released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across major metropolitan areas.

U.S. single-family rent price growth continued at a record pace in March, up 13.6% from one year earlier. Slim inventory continues to squeeze renters, as do robust home price gains – both familiar culprits in declining affordability. As in months past, warmer areas of the country continued to experience the highest rental cost growth, with prices in two large Florida metro areas accelerating at about two-to-three times the national rate.

The 13.6% YoY increase in March was up from 13.1% YoY in February.

Rent Data

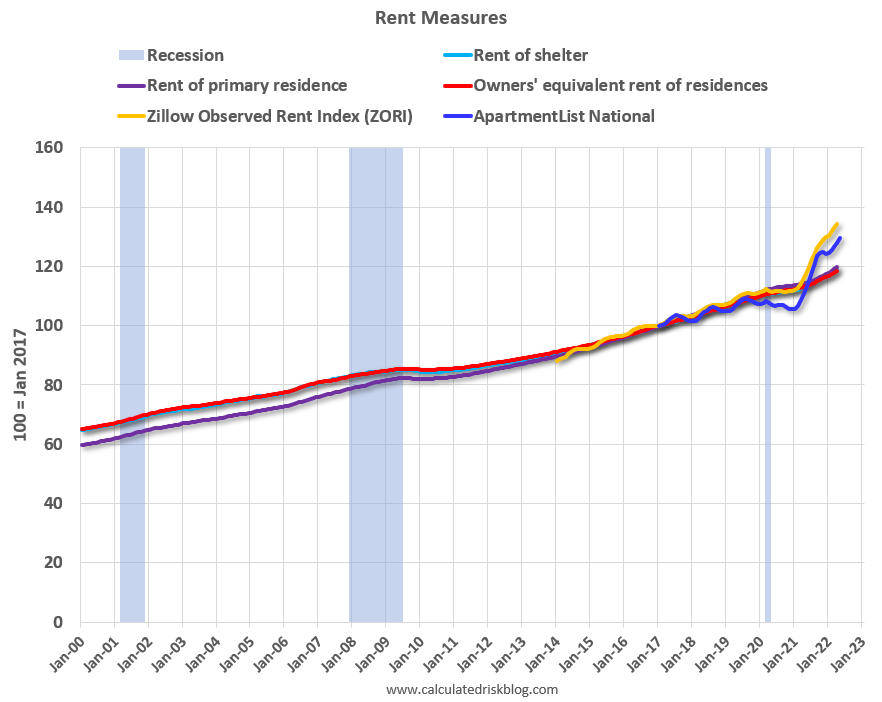

I’m going to update some of the data on rents. Here is a graph of several measures of rent since 2000: OER, rent of shelter, rent of primary residence, Zillow Observed Rent Index (ZORI), and ApartmentList.com. (All set to 100 in January 2017)

Note: For a discussion on how OER, and Rent of primary residence are measured, see from the BLS: How the CPI measures price change of Owners’ equivalent rent of primary residence (OER) and rent of primary residence (Rent)

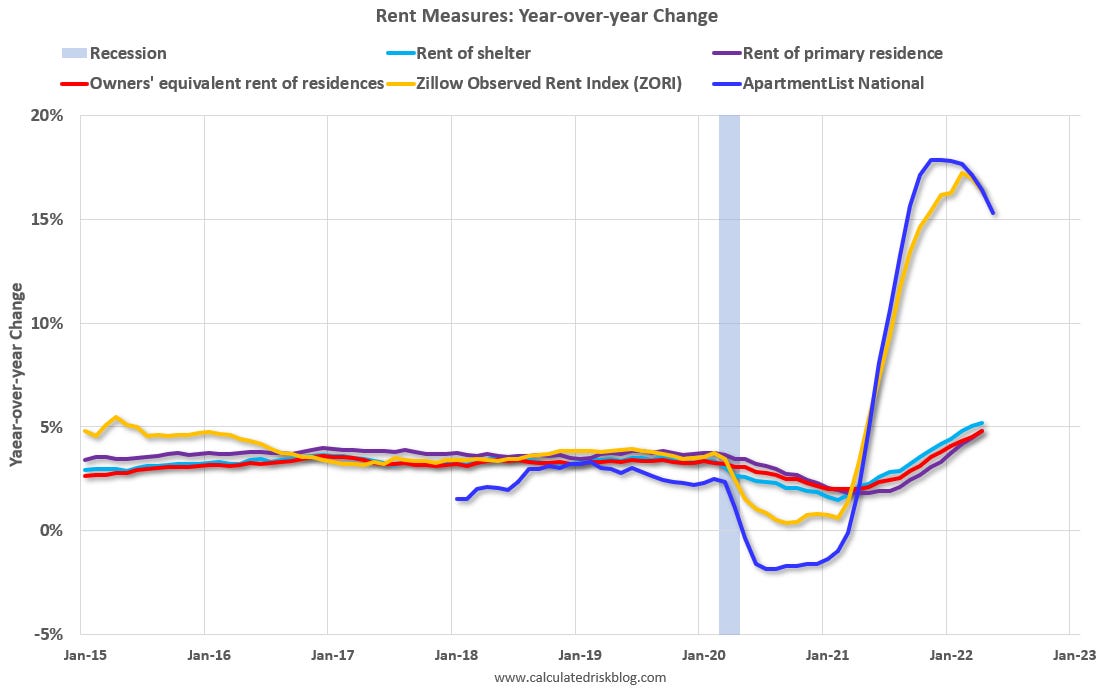

OER, rent of shelter, and rent of primary residence have mostly moved together. The Zillow index started in 2014, and the ApartmentList index started in 2017. Here is a graph of the year-over-year (YoY) change for these measures since January 2015. All of these measures are through April 2022 (Apartment List through May 2022).

Note that new lease measures (Zillow, Apartment List) dipped early in the pandemic, whereas the BLS measures were steady. Then new leases took off, and the BLS measures are picking up.

The Zillow measure is up 16.4% YoY in April, down from 17.0% YoY in March. This is down from a peak of 17.2% YoY in February.

The ApartmentList measure is up 15.3% YoY as of May, down from 16.4% in April. This is down from the peak of 17.9% YoY last November.

Both the Zillow measure (a repeat rent index), and ApartmentList are showing a sharp increase in rents. From Zillow:

“ZORI is a repeat-rent index that is weighted to the rental housing stock to ensure representativeness across the entire market, not just those homes currently listed for-rent.”

And from ApartmentList:

At Apartment List, we estimate the median contract rent across new leases signed in a given market and month. To capture how rents change in a market over time, we estimate the expected price change that a rental unit should experience if it were to be leased today.

Both of these measures reflect new leases, whereas most rental units don’t turnover every year (as captured by the BLS measures). This sharp increase in new lease rates should spill over into the consumer price index over the next year (as discussed in earlier article).

Clearly rents are still increasing, and we should expect this to continue to spill over into measures of inflation in 2022. The Owners’ Equivalent Rent (OER) was up 4.8% YoY in April, from 4.5% YoY in March – and will likely increase further in the coming months.

My suspicion is rent increases will slow over the coming months as the pace of household formation slows, and more supply comes on the market.

More From The Real Estate Guys…

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!