While American media is focused on the chances of a Thanksgiving weekend terrorist attack (not to make light of those concerns)…a group of international bureaucrats will be meeting to decide if the world will take a step closer to a Chinese yuan reserve currency.

On Monday November 30th, the International Monetary Fund (IMF) votes on whether the yuan (the currency of China, also known as the renminbi) gets into the Special Drawing Rights (SDR) basket.

Who cares?

China does. They care a LOT. And YOU should probably care too…even if you don’t know it yet.

What is an SDR?

Special Drawing Rights (SDR) are the currency of the International Monetary Fund.

The SDR “basket” is a collection of “premium” currencies whose values collectively determine the value of the SDR using a special formula.

Confused already? That’s okay. Just don’t give up….

Remember all those real estate investors in 2005 that didn’t pay attention to Wall Street…thinking what do stocks, bonds and derivatives have to do with Main Street real estate investing?

In 2008 we all found out. Oops.

So here’s a quick primer on the situation (for a better understanding, read Jim Rickards’ books Currency Wars and Death of Money)…

In the U.S., when an individual bank runs low on cash, they can borrow from the central bank (the Federal Reserve). All major countries have a similar system.

But where do central banks go when they need to borrow?

So here’s where it gets a little complicated. But stick with us because we plan to show how it matters to you and your Main Street investing.

A little history…

What is the IMF?

Prior to 1944, countries settled trade in gold. So if you imported more than you exported, you owed someone a pile of shiny yellow metal. Or at least a claim ticket for it. Makes sense.

Prior to 1944, countries settled trade in gold. So if you imported more than you exported, you owed someone a pile of shiny yellow metal. Or at least a claim ticket for it. Makes sense.

After two world wars, most of the world’s gold and remaining production capacity was primarily in the United States.

After all, it’s hard to export anything when all your production capacity and infrastructure was bombed to smithereens. So almost by default (not that Americans weren’t smart and didn’t work hard) the U.S. had the world’s dominant economy.

In 1944, at the Bretton Woods conference, a NEW financial order was set up…and the U.S. took over for Great Britain as the financial capital of the world.

Remember the golden rule? “He who has the gold, makes the rules.”

That’s what happened in Bretton Woods. The U.S. had the gold, so King Dollar was crowned. For most folks reading this, it’s the only system you’ve ever known.

But that doesn’t make it permanent. In fact, history tells us that dominant economies, currencies, governments and systems eventually change.

Anyway, the idea of a central bank for the central banks also came out of Bretton Woods. They called it the International Monetary Fund or IMF.

Five years later, it launched. Keep in mind that these things take time. It’s easy to miss…or forget…that fundamental change is happening.

Basically, the IMF is the central bank to the central banks.

Twenty years later, in 1969, the idea of a special currency for the IMF came up. They called it “Special Drawing Rights” or SDR.

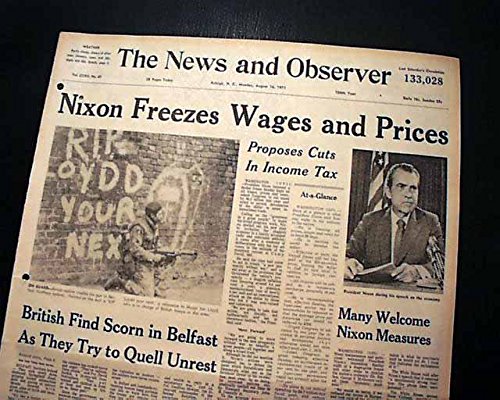

Lame name, but lucky timing (probably just a coincidence…) because just two years later, in 1971, the U.S. defaulted on the Bretton Woods agreement with the “Nixon shock”.

That’s when President Richard Nixon shocked the world on national TV announcing he was closing the gold window “temporarily”. (Still closed today by the way…)

But don’t take our word for it…watch Nixon make the announcement yourself:

The ORIGINAL Bretton Woods deal was that countries holding paper dollars could turn them into Uncle Sam and get real gold. In essence, the dollar was as good as gold.

But when Nixon suddenly changed the deal (reminds us of the exchange between Darth Vader and Lando Calrissian in Star Wars – The Empire Strikes Back below), it meant all countries holding U.S. dollars formerly redeemable for U.S. gold now simply held green pieces of paper with pictures of dead U.S. leaders.

Now…to no surprise…no one wanted or trusted U.S. dollars. So the dollar crashed. Gold and inflation soared. The U.S. economy and stock market tanked. “Stagflation” became the term to describe a new strain of economic malaise.

Research it yourself. There are many important lessons to be learned about how a major economic policy change ripples through economies.

And sometimes the UNTHINKABLE happens.

For example, in a vain attempt to contain the inflation unleashed by his default on the gold dollar, Nixon instituted a wage and price freeze:

Who would think that in the Land of the Free, it would be a FEDERAL CRIME to give an employee a raise…or to raise the price of the merchandise in your OWN store?!?

But it happened. In America.

The point is that defaulting on the Bretton Woods promise to redeem dollars for gold was a HUGE reset.

The gold dollar was dead.

BUT…the U.S. still had a strong balance sheet, a big army, huge manufacturing capacity…and a plan.

Shortly thereafter, the petro-dollar was born.

“Petro-dollar” just means that the U.S. dollar became the currency which worldwide oil transactions were settled in. It created a huge and ever-present permanent new demand for U.S. dollars.

Now there’s SO much more to say about that…but not today.

Again, we encourage you to study the history of the dollar, gold and oil. Or come to a live event and buy us a beer or two or three…and we can talk about all this until the wee hours (that’s what happens after a few beers…)

Back to our story…

So now we’re in the petro-dollar era and the IMF is there with its SDRs and the SDR value is based on a “basket” of currencies it’s indexed to.

The SDR basket is made up of all the “best” currencies…the U.S. dollar, the British pound, the Japanese yen, and the European Union’s euro.

That’s a pretty exclusive club considering there are 190+ countries out there.

China wants the yuan to join the SDR club.

But at the last vote in 2010 (these things only get looked at every 5 years), they got voted down.

Not dissuaded, China went to work. We chronicle much of this in our special report on Real Asset Investing.

But this time, it seems China has a Plan B…in case the IMF slams the door again.

So while they’re working to comply with IMF requirements, China’s also taken steps to go independent if need be.

Does China want a yuan reserve currency?

We don’t know. If Beijing calls us with a heads up, we’ll be sure to pass it along.

But how often can you trust anything ANY government says? It’s better to WATCH what they DO.

Right now, it seems to us that China looked at what the U.S. did to be top dog at Bretton Woods and are copying it as best they can.

It’s a long list, but some notable items are:

- Build a huge manufacturing economy. #1 in the world. Check.

- Build a huge army. Currently #3 in the world and growing. Check.

- Build huge financial reserves. #1 by more than DOUBLE. Check.

- Accumulate huge gold reserves. #5 in the world and growing faster than anyone else. Check.

Pay close attention to that last one. We think this will be a BIG story in the not too distant future.

In 2015, China formed its own international bank (the AIIB – Asian Infrastructure Investment Bank) in spite of U.S. resistance…and wooed dozens of countries to join, including Uncle Sam’s “pal”, Great Britain.

It’s kind of like, “If you can’t join them, beat them.” Or at least show you’re ready to beat them if necessary.

But no one wants to fight the U.S. toe to toe…including China. Better to get voted in with a yuan reserve currency.

Of course, the U.S. has an effective veto with over 16% of the IMF voting rights (it takes 85% to pass). So even if Uncle Sam’s buddies don’t back him again, he can still stop China from getting in the club.

But we think China’s ready for that. And we think Uncle Sam knows China’s ready. So we wouldn’t be surprised if Uncle Sam cries…well, uncle.

But who knows? We’ll find out soon enough.

THEN…it will be interesting to see what happens next.

If China gets in, it’s like adding a new stock to the S&P 500. It creates an immediate spike in demand for the new stock…and something gets dumped to make room.

Art Cashin, Director of Floor Operations at UBS and famed commenter on CNBC has been quoted saying…

“If [SDR] approval were given, we could be looking at shifts in the trillions of dollars.”

“If [SDR] approval were given, we could be looking at shifts in the trillions of dollars.”

We’re not that bright, but when a BIG shift happens we know to pay attention.

In that same article, Lombard Street Research’s chief economist and head of research, Diana Choyleva was quoted…

“’If the yuan goes in the basket, then the likelihood is that the Chinese would prefer a gradual depreciation of their currency against the US dollar.’”

And if the yuan is NOT accepted?

Choyleva says…

“The Chinese leadership is not going to wait another five years…And they will not be so keen to be such a responsible global citizen….If the yuan is not accepted in the SDR, they will go for a one-off large devaluation and that would then be … a financial crisis, specifically, a real-economy crisis with the resulting impact on the …markets.”

Another financial crisis doesn’t sound like any fun.

It SEEMS like Uncle Sam and China are actually working closely together to gently ease a Chinese yuan reserve currency into the club.

But like raising kids, adolescents always think they’re ready too soon…and parents always hold on too long.

China’s clearly growing up. And China’s financial decisions affect Americans…even real estate investors on Main Street.

This headline is a case in point:

“…U.S. Steel blamed the temporary closure on tough market conditions ‘including fluctuating oil prices, reduced rig counts and associated inventory overhang, depressed steel prices and unfairly traded imports.’”

“Earlier this year, U.S. Steel permanently shuttered a longtime plant outside of Birmingham, Alabama, laying off 1,100 workers. That closure came on the heels of a string of layoffs in Texas, Arkansas, and Indiana, among other states.”

Those are all working class jobs in great rental property states.

Getting closer to home now?

The article continues…

“[China’s] recent slowdown threatens to exacerbate problems for American steelmakers, as Chinese policymakers look to boost exports and more steel hits the global market.”

The Chinese policies referred to include tweaking the relative strength of the yuan…because a cheaper yuan means cheaper goods into the U.S., which costs U.S. jobs.

And this is just ONE industry. Think of ALL the other industries China is involved in…especially in any markets YOU are invested in.

So what’s an investor to do if there is a Chinese yuan reserve currency?

Pay attention.

Watching two elephants dance isn’t exciting.

They aren’t graceful and they move slowly.

But when you’re locked in the same economy and those elephants can crush you, you’re wise to stay alert. And everyone knows we need more lerts. 😉

So REALLY get to know YOUR markets, demographics, ultimate income sources, and critical dependencies.

You want to see weakness or opportunity before others so you can move in or move out ahead of the crowd.

Remember, it takes time to tweak a real estate portfolio. Of course, compared to the dancing elephants, you’re a water bug. But you still need to be looking and moving ahead

Focus on macro trends.

China’s been working on getting into the SDR club more than a decade. The dollar’s recent strength is an aberration in a well-chronicled 100 year slide.

You’ll lose sleep…and hair (we know)…trying to understand every tick in some chart. Looking at the big picture smooths out a lot of the noise.

Watch for game changers.

Bretton Woods in 1944 was a game changer. A fundamental change to the global financial system.

Bretton Woods in 1944 was a game changer. A fundamental change to the global financial system.

The Nixon Shock in 1971 was a game changer. Another fundamental change to the global financial system.

China’s ascension has been a slowly developing game changer.

It used to be Americans could just go about their business. The rest of the world was too puny to really severely impact the mighty U.S. economy and dollar.

Now, when China gets a cold, so does Uncle Sam. You can read it in the news everyday.

Is adding the Chinese yuan into the IMF SDR a game changer?

We don’t know yet. Could be.

Or maybe the Chinese will do a reverse Nixon shock. We’re pretty sure THAT would be a game changer. (Think about it…)

Invest in things that are REAL and ESSENTIAL.

It’s our recurring theme. Housing, food, energy, commodities. All have roots in real estate. Sure, they can go boom and bust. But they’re ALWAYS needed. Pets.com? Not so much.

Use financial structures which can withstand economic pull backs.

The flirty girl at the frat party might get a lot of attention, but she’s not the one you take home to Mama.

Bubbles and leverage create lots of sexy opportunities, but when the glitter rubs off, you want to be with markets, product types, demographics and teams which are in it for the long haul.

Credit lines, equity and buyers all can (and usually do) disappear when you need them the most. They’re fickle.

A little cash on hand can be your best friend in a downturn. If you have your chips on the table and get a bad roll, you’re out. Donald Trump told us he learned it’s ALWAYS good to have some cash available in the down times.

So don’t envy the guy getting lucky with the hot deal when it’s all sunshine. Otherwise, you’ll certainly be envying the guy with the stable portfolio when the clouds come.

Now if you’ve read this far, we’re guessing you’re SERIOUS about understanding these chaotic times. We are too.

So if you REALLY want to jump start your learning…

We invite you to invest a week to sharpen your understanding of economics, investing and real asset portfolio strategies aboard our 14th annual Investor Summit at Sea.

One of our discussion topics will be The Future of Money and Banking…with Robert Kiyosaki, G. Edward Griffin and experts in economics, precious metals, crypto-currency and alternative banking. Not to mention real estate, tax and estate planning, asset protection and more. Your brain will hurt. But you’ll LOVE it.

>>> Click here now to learn more about the next Investor Summit at Sea.

Meanwhile, stand by….and we’ll let you know whether there’s a Chinese yuan reserve currency in your future.