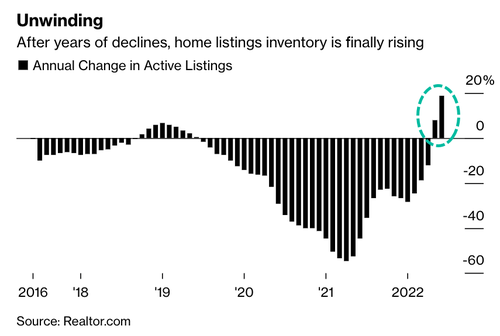

The red hot pandemic-era housing market is cooling as historically tight available inventory shows signs of reversing.

An affordability crisis has removed millions of new home buyers as the number of active US listings soared 18.7% in June from a year earlier, the most significant increase in Realtor.com’s data going back to 2017, according to Bloomberg. The days of insane bidding wars, waiving home inspections, and putting in an offer 20% or more over the list price appear to be over. In other words, a buyer’s market could be emerging.

“While we anticipate that more inventory will eventually cool the feverish pace of competition, the typical buyer has yet to see meaningful relief from quick-selling homes and record-high asking prices,” said Danielle Hale, chief economist for Realtor.com.

Austin, Texas; Phoenix, Arizona; and Raleigh, North Carolina saw active listings more than double from a year ago. Nashville, Tennessee, active listings jumped 86%, and 72% in the Riverside, California.

The Federal Reserve’s most aggressive tightening campaign sent the 30-year fixed-loan mortgage rate from 3% to over 6% this year (back in March, we warned coming rate explosion would trigger a housing affordability crisis), removing millions of new home buyers who can’t afford the cost of homeownership as the median existing-home sales price was around $407k in May.

Even though inventory is historically tight, supply is expected to increase in markets across the country as demand for loan applications among prospective buyers slumps. Fewer buyers equal more inventory.

The takeaway is that inventory is rising as homes stay on the market longer because demand evaporated thanks to the housing affordability crisis — this could mean a housing top is nearing.