Lockdowns, restrictions, eviction moratoriums, civil unrest, election hysteria. Fun times.

It’s enough to make a real estate investor order one bourbon, one scotch, and one beer … assuming you could find an open bar.

But before you reach for the Valium and TV remote, remember …

“Never make a permanent decision based on a temporary storm. No matter how raging the billows are today, remind yourself: This too shall pass!”

– T. D. Jakes

Sitting out troubling times is a permanent decision … because today’s opportunities are only here today. When you miss one, it’s gone.

And when today’s troubles are setups for tomorrow’s sunshine, standing pat can mean being out of position later.

We’re not saying to play in the rain without a raincoat. You need to be smart in all situations. And yes, there are times when a strategic retreat is wise.

But we see some folks just disengaging. That’s usually a mistake.

Even though we’re in harrowing times, there are reasons for real asset investors to be optimistic about the future … even on a rocky road to riches.

Surely you didn’t think it would be EASY?

So while there are a thousand hot headlines we could dissect in the middle of this pandemic / election cycle / potential system meltdown …

… better to stay anchored on timeless principles which are useful for navigating all the noise.

Because … as they say … stuff’s about to get REAL. And that’s going to be good for those aware and prepared.

For decades … through wars, recessions, currency resets, assassinations, impeachments, civil unrest, political scandals, disputed election results …

(Yes, ALL those scary things … and more … have happened before)

… professional investors reposition their portfolios … often shifting from offense to defense. But always staying PROACTIVE.

And though many of those professional investors are playing on Wall Street … the principles apply to Main Street investing as well.

So let’s look at some Wall Street defensive strategies and translate them into Main Street lessons for real estate investors.

Ride the Equity Wave … Carefully

In times of enormous currency creation (monetary stimulus) and government spending (fiscal stimulus), it’s hard to sit on the sideline. That’s a lot of fuel.

Come Merry Men, let’s ride this stock rocket to the moon!

Sure, things could crash. But they could boom big until they crash.

Just remember they can also do both at the same time … and what it means when it happens (not good).

But except for the very rarest of circumstances, pros don’t ever get out of the market completely. It’s about allocation … not abdication.

S0 while aggressive investors chase unicorns and sexy stories … defensive players often shift to “Consumer Staples”.

In other words, they seek shelter in things which are essential at all times.

Translating to real estate, we think markets and properties in the residential, distribution, agricultural, healthcare, and energy niches are “staples”.

No matter what’s happening in the world, or what currency it’s happening in, these properties are likely to remain valuable and productive.

Of course, they might be a little boring. But in tumultuous times, boring is beautiful.

But … even modest returns can be goosed through the careful use of long-term, low-interest rate debt. And today’s market has some of the lowest rates ever.

Even if your portfolio is already stuffed with its unfair share of residential properties and dripping with equity …

… you can use cash-out refinances to lock in low-rates and reposition equity into other niches where financing is less available.

Load Up on Cheap Debt

It’s no secret corporate CFO’s have been borrowing like crazy and buying up their own stock … even while sitting on piles of cash.

Pros like to borrow cheap and long and load up on quality assets they understand …

… and to have “dry powder” ready when other quality assets are shaken out of weak hands.

A word to the wise … be very wary of borrowing short and lending or investing long. Only banks backed by the FDIC and Fed can play that game “safely”.

Increase Liquidity

Extra cash isn’t simply dollars in the bank … and it’s not just for bargain shopping when markets get temporarily ugly.

Liquidity is a VERY important buffer when unexpected things disrupt all your well-laid plans. Murphy is alive and well.

Liquidity is like oxygen. You can last a while without profit … and even without revenue …

… but when you’re out of cash (or assets quickly convertible to cash), you’re in serious danger. It’s like drowning.

And remember: Credit lines don’t count because they can be shut off without warning … usually when you need them the most.

However, precious metals are an alternative store of liquidity … and allow you to pivot into ANY currency easily … which comes in handy when currencies crash.

Prioritize Principal Preservation

Warren Buffett’s #1 rule for investing is “Don’t lose money”. His rule #2 is “Always remember rule #1”.

But losing comes in different flavors. And sometimes a flight to safety is really a leap from the frying pan into the fire.

This is where we see REAL opportunity for real estate investors …

The basic defensive play for paper investors when they get spooked is to jump into U.S. bonds and dollars. BUT …

U.S. bonds and dollars are no longer the reliable havens of safety they once were … as evidenced by the popularity of gold and silver.

We’ve covered this in detail many times … but because it’s arguably the most important underlying financial story right now and so few in the real estate world are talking about it, we’ll touch on it again briefly.

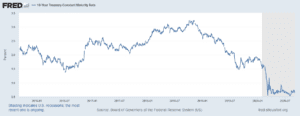

When interest rates RISE, bond values fall.

Of course, when rates are at rock bottom (like they are), there’s a big danger rates might rise.

For real estate investors, rising rates are an annoyance. But for bond investors, rising rates are a DISASTER.

Think of it like rising cap rates in a rent control area. The increased cap rate isn’t from growing rents. It’s from FALLING prices. You’re losing equity.

This is what happens to bond investors when rates rise. Any bonds held LOSE value. Rising rates don’t mean more income. They mean LOSS of principal.

Consider that U.S. bonds are denominated in U.S. dollars, so bondholders get paid back in dollars. This sounds good, but it can be a problem.

So keep your thinking cap on and don’t give up now …

To keep rates down, the Fed prints lots of dollars to buy bonds. This dilutes the value of the dollars, which bondholder get paid back …

(it’s called “inflation”)

… and the Fed just announced they plan to let inflation run hot … that is, to overshoot 2 percent CPI (don’t get us started …)

Here’s the point and why it matters to real estate investors …

Like real estate, there are buy-and-holders and flippers.

Flippers buy bonds hoping rates go DOWN (driving principal UP) so they can sell at a profit. They don’t want yield and they’re not in it for the long haul.

They’re flipping for capital gains.

Buy-and-hold investors ARE seeking yields … and finding the cupboard pretty bare …

So with bonds yielding less than inflation, bondholders are already losing on income … but in danger of losing worse if rates rise.

In today’s world, bonds are terrible for both producing income AND for preserving principal long term.

Gold is good for the latter but produces no income.

And yes, paper investors can seek yields in dividend paying stocks. But this exposes them to extreme price volatility (after all, it is the stock market).

The bigger issue is companies world-wide are cutting dividends … the most since the last crash … in an effort to preserve cash during the pandemic.

This creates a HUGE opportunity for real estate investors … and especially for syndicators of cash-flowing properties.

The yields on real estate are better than bonds. And if a tenant defaults, they can be replaced. If a bond issuer defaults, you lose. So real estate wins.

Plus, the underlying asset (the property) which generates the income is a physical, tangible asset … not some “going concern” which might stop going.

(There’s probably a reason China borrowed to the moon and built ghost cities … when the debt goes bad, the properties remain … and who’s foreclosing?)

Another plus … real estate not only benefits from inflation but is often the intentional target of it (to protect the banks who lent against it).

And PLUS PLUS … (IMPORTANT) … think about this …

… it’s MUCH easier for politicians and central bankers to feed money to Main Street so mortgages and rent can be paid … than to feed big corporations so dividends can be paid. Good optics vs BAD optics.

For those who prefer to own debt, mortgages are better than bonds.

Again, the debt is backed by the property. If the borrower fails, the lender gets the property AND its income.

As Main Street investors who’ve been blindly following Wall Street advice begin to understand all this, we think the smart ones will come home to real estate.

We could go on … and on … and on … but you get the idea.

Real estate investors need to smart, careful and creative right now … but there’s no reason to be hiding in the basement.

Real estate is a great shelter in a storm.

Not the time for hiding in the basement …

Facebook

Twitter

LinkedIn

Email

- Filled Under: All Posts, Clues in the News

- Tagged With: bond investors, bonds, cash flow, coronavirus, covid-19, debt, equity, Feed - Pod - Blog - Clues in the News, Interest Rates, investing, investment, investor, investors, pandemic, passive income, precious metals, real asset investors, Real Assets, Real Estate, real estate guys, real estate investing, real estate investor, residential real estate, the real estate guys radio show, Warren Buffett

Be the first to know when new content arrives!

Explore The Archives

Archives

Podcast: Hands-On vs. Hands-Off Investing Strategies

November 30, 2025

Podcast: What $4,000 Gold Means for Real Estate Investors

November 9, 2025

The Real Estate Guys™ Guests and Contributors Have Been Featured On: