As of this writing, we’re not sure what the Fed will do with interest rates, though it’s widely expected they’ll cut.

So as much as we’d like to talk about what it means to real estate investors, we’ll wait to see what happens.

And even though mainstream financial media are finally paying attention to gold and the future of the dollar … these are topics we’ve been covering for some time.

But if you’re new to all this, consider gorging on our past blog posts …

… and be sure to download the Real Asset Investing report …

… and for the uber-inquisitive, check out the Future of Money and Wealth video series.

After all, this is your financial future … and there’s a LOT going on.

In fact, today there’s a somewhat esoteric and anecdotal sign the world might be on the precipice of its next major financial earthquake.

But before you go full-fetal, this isn’t doom and gloom. We’re too happy-go-lucky for that.

It’s more an adaptation of a principle from Jim Collins’ classic business book, Good to Great …

Confront the brutal clues.

Of course, the original phrase is “Confront the brutal facts.” But as great as data is, sometimes data shows up too late to help.

So, while facts may confirm or deny a conclusion … clues provide awareness and advance warning.

But just like with facts, you must be willing to go where the clues lead.

In this case, we’re just going to look at one clue which has a history of presaging a crack up boom.

For those unfamiliar, a crack up boom is the asset price flare up and flame out that occurs at the end of an excessive and unsustainable credit expansion.

In other words, before everything goes down, they go UP … in spectacular fashion.

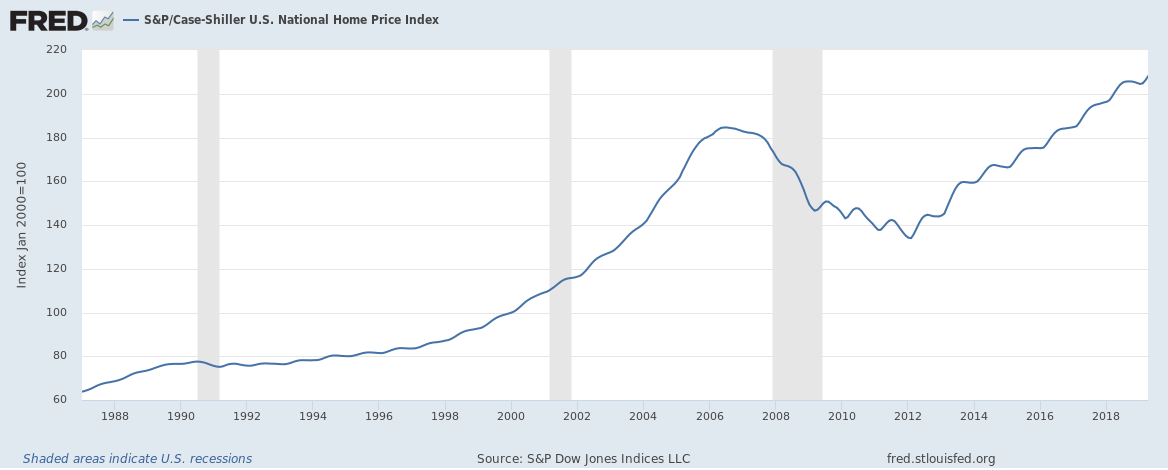

Here’s a chart of the housing boom that eventually busted in 2008 …

See the bubble that peaked in 2007? It’s hard to miss … in hindsight. It’s hard to see when you’re in the middle of it.

Peter Schiff saw it in 2005 and published his book, Crash Proof, in 2006 to warn everyone. Few listened. Some mocked.

In 2008 it became painfully obvious to everyone.

Of course, for true real estate investors … those busy accumulating tenants and focusing on the long-term collection of rental income …

… asset prices are only interesting when you buy, refinance, or sell.

As long as you stay in control of when you buy, refinance, or sell … you can largely ride out the bust which often occurs on the back end of a boom.

And if you’re paying attention, you use boom time as prime time to prep … and the bust as the best time to buy.

Today it’s safe to say, just based on asset prices alone, we’re probably closer to a bust than another big boom.

But the current run-up could still have more room to boom. As we said, it’s hard to tell when you’re in the middle of it.

Shrinking cap rates are one of the most followed metrics for measuring a boom.

Cap rates compress when investors are willing to pay more for the same income. That is, they pay more (bid up the asset price) for the same income.

But when the Fed says low-interest rates are the new normal, maybe it means so are low cap rates.

It’s one of MANY ways Fed policy ripples through the economy … even real estate.

But there’s another sign that’s hard to see unless you’re an industry insider, and while not scientific or statistical, it still makes a compelling argument the end is nearing …

Lending guidelines.

Think about it … booms are fueled by credit. It’s like the explosive fuel which propels rising asset prices.

The only way to keep the boom going is to continually expand credit.

But any responsible head of household knows you can’t expand credit indefinitely … and certainly not in excess of your capacity to debt service.

At some point, the best borrowers are tapped out. So to keep the party going, lenders need to let more people in. That means lowering their standards.

We still have a “backstage pass” to the mortgage industry and see insider communications about lenders and loan programs.

When this subject line popped up in our inbox, we took notice …

24 Months of Bank Statements NO LONGER REQUIRED

To a mortgage industry outsider that seems like a lame subject line. But to a mortgage broker trying to find loans for marginal borrowers, it’s seductive.

It suggests less stringent lending criteria. Easier money.

Sure, the rates are certainly higher than prime money. But with all interest rates so low, they’re probably still pretty good.

And these are loans with down payments as low as 10% for borrowers just 2 years out of foreclosure or short-sale. Hardly a low risk borrower.

Usually, lenders want to see TWO years of tax returns and a P&L for self-employed borrowers. They’re looking for proof of real and durable income.

Not these guys. Just deposits from the last 12 months banks statements. And they’ll count 100% of the deposits as income, and won’t look at withdrawals.

So a borrower could just recycle money through an account to show “income” based solely on deposits.

The lender is making it STUPID EASY for marginal borrowers to qualify.

All of this begs two questions:

First, why would a lender do this?

And second, why would a borrower fabricate income to leverage into a house they may not be able to afford?

We think it’s because they both expect the house to go UP in value and the lender is growing increasingly desperate to put money to work at a decent yield.

Pursuit of yield is the the same reason money is flowing into junk bonds.

And if the Fed drops rates as expected, it’s likely even more money will move to marginal borrowers in search of yield.

Today, MANY things could ignite the debt bomb the way sub-prime did in 2008. Consumer, corporate, and government debt are at all-time highs.

Paradoxically, lower interest rates take pressure off marginal borrowers … while adding to their ranks.

It’s hard to perfectly time the boom-bust cycle.

But careful attention to cash-flow protects you … whether structuring a new purchase or refinance. It means you can ride out the storm.

Meanwhile, it’s smart to prepare … from liquefying equity to building your credit profile to building a network of prospective investors …

… so if the bust happens, you have resources ready to “clean up” in a way that’s positive for both you and the market.

No one knows for sure what’s around the corner … but there are signs flashing “opportunity” or “hazard”.

Both are present, but what happens to you depends on whether you’re aware and prepared … or not.

Until next time … good investing!

More From The Real Estate Guys™…

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.