After new- and existing-home sales tumbled, it should have been no surprise that pending home sales dropped in April. The 3.9% MoM decline was almost double the 2.1% drop expected and is the 6th straight monthly decline in sales (the longest losing streak since 2018)…

Pending home sales are now down 11.5% YoY – the biggest YoY drop outside of the great financial crisis (ex COVID lockdowns and the homeowner tax credit anomalies in 2010).

“Pending contracts are telling, as they better reflect the timelier impact from higher mortgage rates than do closings,” NAR’s chief economist Lawrence Yunsaid in a statement.

“Home prices in the meantime appear in no danger of any meaningful decline.”

Outside of the COVID lockdown drop, this is the weakest SAAR since 2014…

Contract signings fell in all regions but the Midwest.

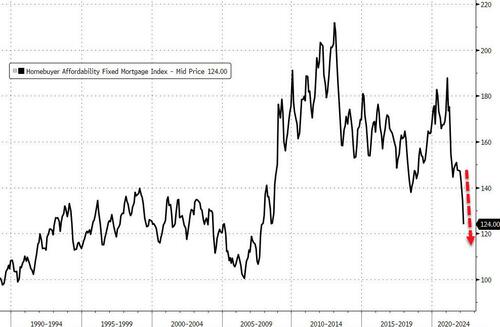

None of this should be a surprise since soaring mortgage rates along with ever-increasing home prices has sent affordability crashing to 20 year lows…

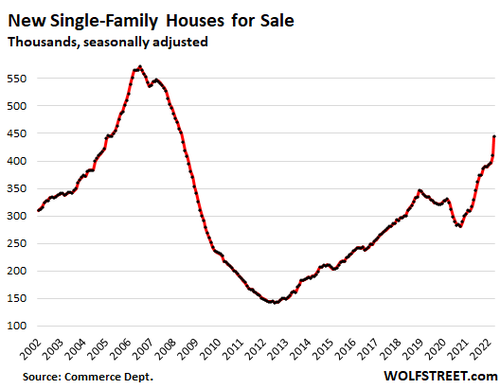

Which helps explain the fact that unsold inventory of new houses spiked in a historic month-to-month leap of 34,000 houses, and by 127,000 houses from April last year, to 444,000 unsold houses, seasonally adjusted, the highest since May 2008.

Both, the month-to-month leap and the year-over-year leap were the largest leaps ever recorded, both in numbers of unsold houses and in percentages.

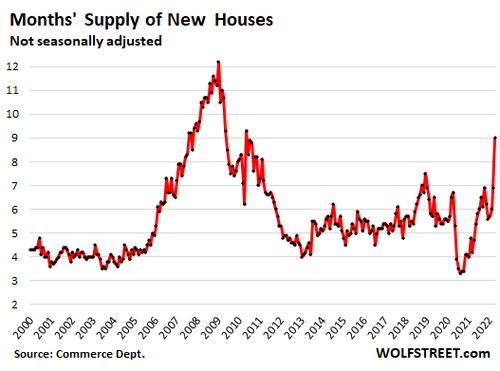

Supply of unsold new houses spiked in a historic month-to-month leap from an already high 6.9 months’ supply in March to a dizzying 9.0 months’ supply in April, having nearly doubled from a year ago:

How much pain is Powell willing to inflict? And when will Biden start complaining?

There is some good news this week though for homebuyers: US mortgage rates posted the biggest drop in more than two years, offering homebuyers a slight reprieve from this year’s massive surge in borrowing costs. The average for a 30-year loan declined to 5.10% from 5.25% last week, Freddie Mac said in a statement Thursday. That was the biggest decline since April 2020, but rates are still well above the 3.11% level at the end of last year.

More From The Real Estate Guys…

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!