Black Knight publishes a monthly Mortgage Monitor report that contains interesting information on the mortgage market and housing.

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage, real estate and public records datasets. While rising home prices and volatile interest rates continue to compound the affordability pressures in the housing market, the same dynamics have also served to increase the housing wealth of American mortgage holders by a significant margin. According to Black Knight Data & Analytics President Ben Graboske, tappable equity – the amount available for mortgage holders to borrow against while retaining a 20% equity stake in their homes – has reached yet another all-time high.

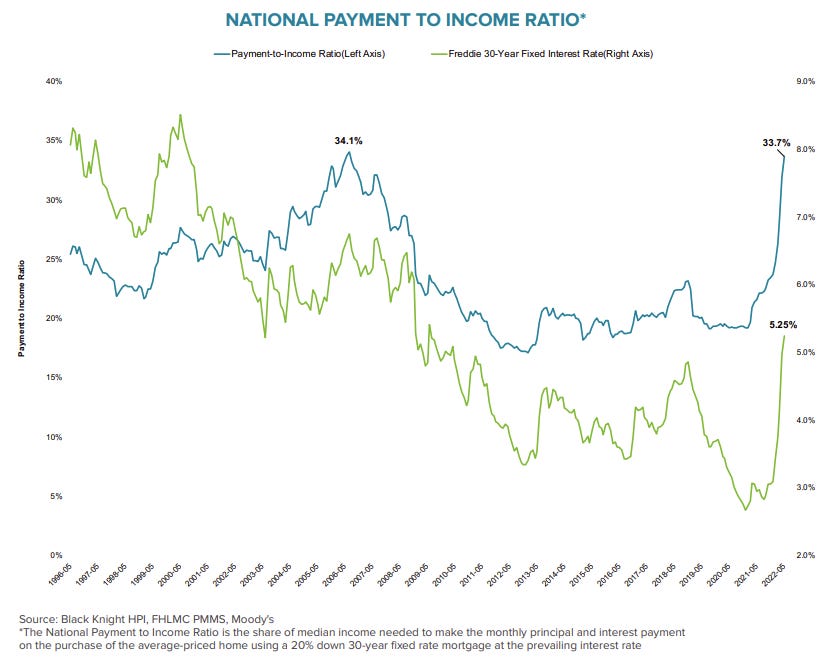

“Home price growth cooled – albeit very slightly – in April,” said Graboske. “While a downward shift from 20.4% to 19.9% annual growth is hardly cause for concern, it’s also likely we’ve not yet seen the full impact of recent rate increases. Rather, April’s decline is more likely a sign of deceleration caused by the modest rate increases in late 2021 and early 2022 when rates first began ticking upwards. The March and April 2022 rate spikes will take time to show up in repeat sales indexes. That said, price growth thus far has created a very difficult environment for prospective homebuyers to navigate. The monthly P&I payment required for the average home purchase is up nearly $600 since the start of the year, and factoring in current income levels housing is now withing a whisper of the record low affordability seen at the peak of the market in 2006. Even modest increases in either rates or home prices at this point would push us over that line.”

emphasis added

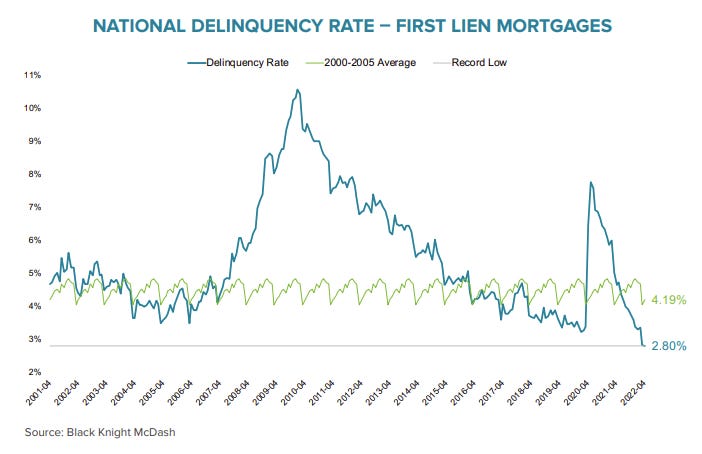

Mortgage Delinquencies at Record Lows

Here is a graph on delinquencies from Black Knight. Overall delinquencies are at record lows.

• The national delinquency rate fell to 2.8% in April, down four basis points from March, hitting a new record low for the second consecutive month

• While delinquency rates typically see seasonal increases in April following declines in March, the increase in 30-day delinquencies was offset by continued improvement in serious delinquencies

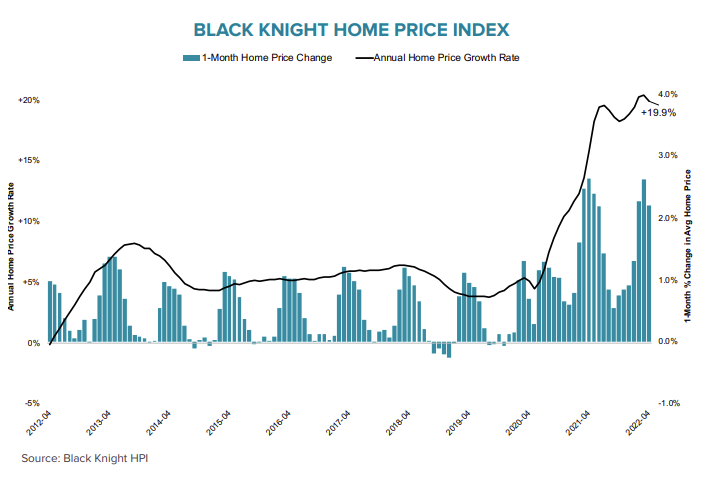

House Price Growth was Strong in April

The second graph shows Black Knight’s estimate of monthly house price increases and the year-over-year change in prices.

• Home price growth showed modest signs of cooling in April, in what may be the beginning of a broader slowdown driven by sharply rising 30-year rates

• Prices were up 19.9% year-over-year in April, slightly cooler than the record 20.4% seen one month prior

• The average home value is up 8.7% over the first four months of 2022

National Payment to Income Ratio

Note: Black Knights data on affordability goes back to 1996. This doesn’t include housing in the 1980 period when 30-year mortgage rates peaked at over 18%.

And on the payment to income ratio:

• May marked the least affordable housing since July 2006, and ranked among the three least affordable months on record

• The monthly payment required to purchase the average price home with 20% down jumped another $100 through mid-May, and is now up nearly $600 (+44%) from the start of the year and $865 (+79%) from the start of the pandemic

• When comparing the rise in housing costs to current income levels, it now takes 33.7% of the median household income to purchase the average priced home, within a whisper of the 34.1% all time high at its peak in June 2006

emphasis added

During the housing bubble, there were “affordability products” with low teaser rates available. Excluding the bubble years, this is the worst affordability since at least the early ‘90s, maybe ‘80s.

There is much more in the mortgage monitor. For example, Black Knight also has data on the status of mortgage loans that were in forbearance.

More From The Real Estate Guys…

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!