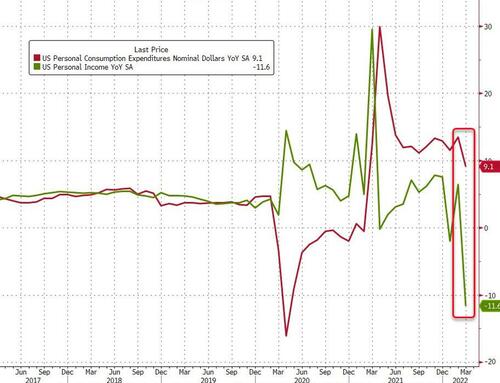

And as the year passes the end of stimmies, the YoY growth in incomes collapses 11.6% (and spending slows to +9.1% YoY)…

Source: Bloomberg

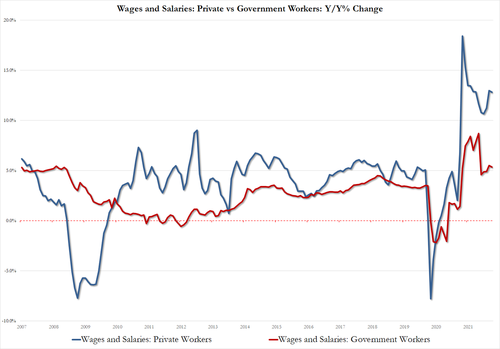

On the income side, private wages rose 12.8% (down from +13.0% last month), and government wages rose 5.4% (down from +5.5% last month)

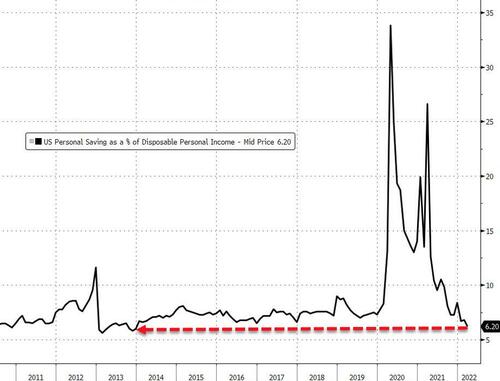

For the 3rd straight month, the increases in spending outpaced the rise in incomes pushing the savings rate to its lowest since Dec 2013

Source: Bloomberg

Finally, The Fed’s favorite inflation rate – the PCE Deflator – rose by 6.6% YoY (slightly less than the 6.7% YoY expected) but still the highest since Jan 1982 (while the core PCE deflator fell back very modestly from multi-decade highs)…

Source: Bloomberg

No breathing room for The Fed here.

More From The Real Estate Guys…

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!