What will stop The Fed?

Investors globally are wondering – after CPI sent the ‘peak inflation’ narrative to the bottom of the ocean and Powell’s Jackson Hole speech (and this FOMC statement and press conference) crushed the ‘Fed Pivot’ narrative – what other potential indicators/signals (aside from a multi-month slowdown in inflation of course) could prompt Powell and his pals to back off their uber-hawkishness?

We thought of six potential minefields that may have to be avoided if The Fed is to pull off its magic trick of hiking rates to over 4.6% and holding them higher for longer…

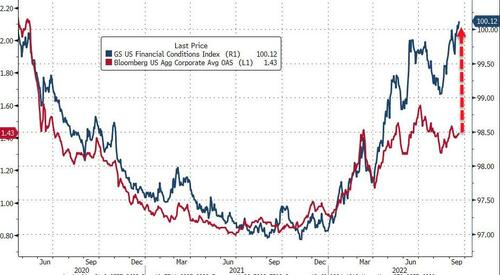

1. Frozen Credit Market

Given the tightening in financial conditions – which Powell said The Fed watches closely – we would already expect corporate borrowing costs to be significantly higher than they are currently…

Worse still, if The Fed’s Median Dot comes true, corporate spreads will be even wider and eventually lead to the market freezing for most corporate issuers.

“Investment-grade credit spreads are by far the most important metric to watch given the large proportion of investment-grade bonds,” said Chang Wei Liang, a macro strategist at DBS Group Holdings Ltd. in Singapore.

“Any excessive widening in investment-grade credit spreads to over 250 basis points, close to the pandemic peak, could induce a more nuanced policy guidance from the Fed.”

Additionally, while the risk premium for credit would widen if The Fed did what it says it will do, given where HY CDS are trading, we would expect a surge in defaults…

With record amounts of debt on the corporate balance sheets, the rising cost of borrowing will kill many of the Fed-enabled zombies that roam the market.

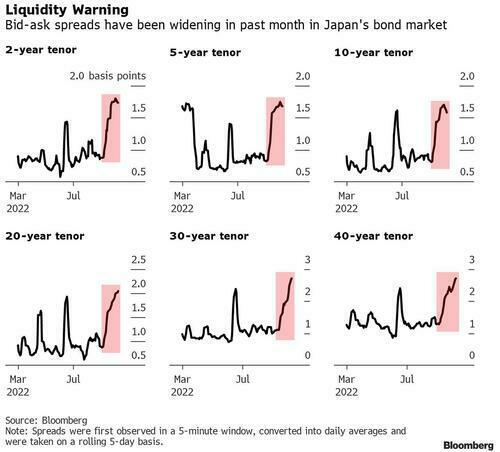

2. Disappearing Bond Liquidity

The last two days have seen zero trades in Japan’s benchmark 10Y government bond.

Additionally, bid-ask spreads for JGBs have exploded since March as liquidity evaporates from the world’s largest bond market.

It’s not just Japan though as US Treasury liquidity has been worsening dramatically in recent weeks, as a Bloomberg index of liquidity for US sovereign is near its worst level since trading virtually seized up due to the onset of the pandemic in early 2020.

And if The Fed gets its way, that illiquidity in the US Treasury market would be at its highest since the great financial crisis, basically killing the conduit for literally trillions of dollars of capital flow…

Are we turning Japanese?

As Bloomberg notes, thin bond-market liquidity would add pressure to the Fed’s efforts to reduce its balance sheet, which ballooned to $9 trillion through the pandemic. The central bank is currently letting $95 billion in government and mortgage bonds roll off the balance sheet every month, removing liquidity from the system.

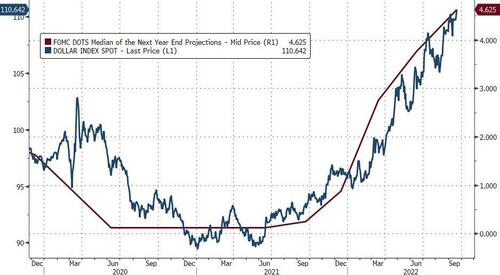

3. Global FX Crisis

The dollar has been soaring – to record highs for DXY Dollar Index – as the yield spread/carry-trade attracts flows out of global fiat and into the USDollar…

However, in FX markets, everything is relative – the dollar can only go up if its fiat peers are going down in purchasing power, and that has historically been a problem.

Right now Europe is bearing the brunt as excessive declines in the euro may fuel concern about worsening global financial stability.

“If the euro fell out of bed, the Fed might not want that to get worse,” said John Vail, chief global strategist for Nikko Asset Management Co. in Tokyo.

“It would be more a global financial stability concept rather than anything related to the dual mandate.”

And the fear is spreading, as China’s state media recently noted (angrily)…

“A super strong US dollar and the fall of other currencies will, to a certain extent, ease the scorching inflation in the US economy, but the world will have to pay for it.“

…the editorial points the finger directly:

” Today, the dollar is once again the world’s problem. In a sense, it’s hard to believe that the “prosperity” of the US is clean and moral…

…Washington keeps laying mines but never removes them, which will eventually explode the US itself. The incompetence of US financial policymakers has been exposed by the consecutive interest rate hikes that have contributed to the abnormal appreciation of the US dollar with the purpose of defusing the severe inflation. “

Now the anxiety and insecurity brought by the US dollar to the world has heralded the beginning of the decline of its hegemony – regarding Washington’s insatiable exploitation, Europe, Asia, the Middle East and other regions have explored the path of “de-dollarization,” leading to the inevitable diversification of the international monetary system.

4. Equity Valuation Re-Rating

If real rates are forward looking – and trading on the basis of what they expect The Fed to do – then even at current levels, US equity valuations are dramatically too rich…

And if the short-term interest-rate market’s expectations are right, US equity prices should fall even further…

Back in February 2020, the former Dallas Fed chief offered some more thoughts about Wall Street’s ‘lost generation’.

“The Fed has created this dependency and there’s an entire generation of money-managers who weren’t around in ’74, ’87, the end of the ’90s, and even 2007-2009.. and have only seen a one-way street… of course they’re nervous.”

“The question is – do you want to feed that hunger? Keep applying that opioid of cheap and abundant money?”

Simply put, investors must be weaned off their dependency on a Fed put, and accept the reality that the ‘wealth’ they thought they had was paper profits and not real.

5. Home Equity Evaporation

Talking of paper wealth, if The Fed’s current planned trajectory for rates is put into action, we should expect a further collapse in existing home sales…

And with that drying up of demand, home prices are expected to fall by an amount similar to the Great Financial Crisis…

And given that Americans’ homes are their largest asset, that is a major blow to the narrative-driven ‘strength’ of the consumer.

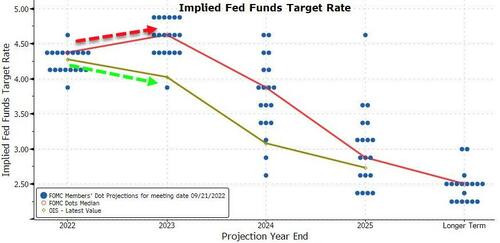

6. Economic Collapse

Finally, and perhaps most importantly, with The Fed’s eye so focused on the inflation side of its mandate, it may cause far worse than a ‘soft landing’ in the economy. If the Median dots come to pass, we should expecte ‘hard’ economic data to go into freefall – and not even the Biden administration will be able to argue that is not a recession…

So, maybe all of this combined is why the market is calling The Fed’s bluff in 2023 – assuming that it will not hold rates ‘higher for longer’, but will be forced by the ugly recessionary (stagflationary more like) environment to cut rates in 2023…

In fact pricing in over 150bps of rate-cuts in the next two years…

Something The Fed is not expecting at all as it sits in its Ivory Tower proclaiming ‘soft landings’ everywhere.

More From The Real Estate Guys…

- Sign up for The Real Estate Guys™ New Content Notifcations

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!