We’re taking a break from our relentless preparation for the upcoming Future of Money and Wealth conference to focus on one our favorite subjects …

Equity.

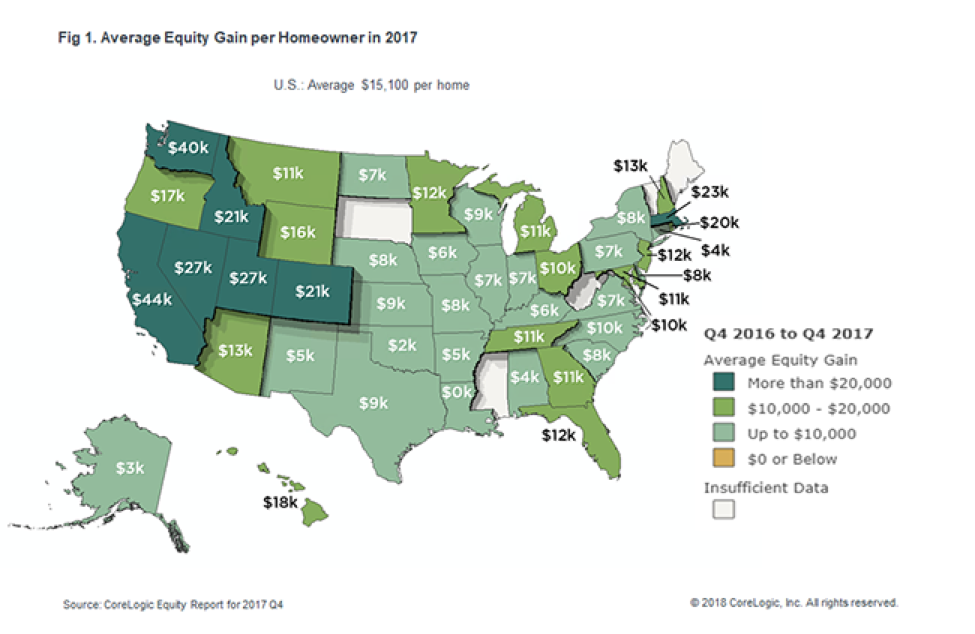

According to a recent report by CoreLogic, last year’s increase in America’s home equity wealth was the largest in four years.

In 2017, the national CoreLogic Home Price Index rose by more than six percent, the largest annual increase since 2013.

We call this “passive equity” because the market just handed it to homeowners simply for buying and holding their property over that time.

Good job.

Of course, national averages are interesting, but not useful for practical investing. Real estate is local right down to the neighborhood and property … and no two are exactly the same.

Think of it this way …

If you have one foot in a bucket of snow at 20 degrees and another in a bucket of 170 degree steaming hot water, on average you’re enjoying a nice soak in a warm bath …

… but in the real world, you’re scalding one foot while you get frostbite on the other. National averages have limited utility.

Fortunately, CoreLogic provides a nifty color-coded map which compares equity growth at the state level:

Unsurprisingly, coastal states with strong technology business … California and Washington … lead the pack for equity growth.

But we’re guessing closer analysis would show equity rich markets are expensive relative to rents, so income investors can’t just go to dark green and buy.

So how’s an investor to use this kind of data?

Here are some ideas for your consideration …

First, you can do a deeper dive into the states with strong equity growth, and look for common factors. Right away, we saw coastal and tech.

But that’s just a start.

Look at supply and demand, nominal and real incomes, job growth, population growth, and migration patterns.

Then talk to street level people who live and work in those markets. Find out what they’re seeing right now.

Once you have your mind around what makes equity happen in one market, you can look for similar conditions in other “emerging” markets.

Then (hopefully) you can make your move and get in early … while the rent ratios still make sense … and ride a wave up.

Of course, if you’re a typical busy person with a small portfolio, that’s a lot of work relative to the size of the investment … especially if you plan to travel to check out markets, build teams, and inspect properties.

Plus, you might not even like doing all that, even if you had the time and a big enough portfolio to justify it.

That’s why we’re HUGE fans of syndication.

Syndication is where a syndicator aggregates funds from a group of investors through a private placement, and then does all the busy work of running the deal … for a fee and a piece of the action.

As long as there’s enough profit in the deals to split equitably, it’s a win-win.

The “passive” investors win because they gain access to opportunities they wouldn’t otherwise have. They effectively leverage the effort, expertise, and relationships of the syndicator.

The syndicator wins because the passive investors’ capital facilitates economies of scale and access to bigger deals the syndicator might not have on his own.

And for both parties, two major sources of investable capital are paper assets in brokerage and retirement accounts, and equity in existing properties that can be re-positioned.

For example, real estate equity in an “appreciated” state might be accessed through a cash-out mortgage for about 5 percent interest at today’s rates.

The loan proceeds can be used to acquire property in an “emerging growth” state that cash-flows at maybe 10 percent cash-on-cash.

The property-owner gets a positive spread on the equity, picks up some valuable tax-breaks, and has additional “top-line” real estate income streams which can grow over time. Same equity, but more future opportunity.

As for stock market equity …

If history is any indicator, the recent turmoil in the paper asset markets is likely to create even more interest in real estate.

That’s because speculating on asset prices, whether it’s stocks or crypto-currencies, is a lot of fun when they’re spiking.

But when the tide turns on speculation … and it always does … real estate’s reputation as a reliable wealth builder is once again revealed and appreciated.

In fact, the CoreLogic article affirms the stability of real estate:

“… since 1970 home-equity wealth has been one-third less variable than corporate equity values …”

And another recently released report from The National Bureau of Economic Research, The Rate of Return of Everything, 1870-2015, says …

“… returns in housing markets tend to be smoother than those in stock markets …”

“… housing has been as a good a long-run investment as equities, and possibly better.”

“… equities do not outperform housing in simple risk-adjusted terms.”

“Housing provides a higher return per unit of risk …”

“… housing returns … are more stable … housing portfolios have had comparable real returns to … equity portfolios, but with only half the volatility.”

The report concludes (remember, to them, “equity” means stocks) …

“… the most surprising result of our study is that long term returns on housing and equity look remarkably similar. Yet while returns are comparable, residential real estate is less volatile …”

“Returns are comparable”, BUT… they didn’t include leverage …

“… the estimates … constitute only un-levered housing returns …”

When you add in 4:1 leverage (25 percent down), you take a 6 percent real estate equity growth rate to 24 percent!

Of course, we’re probably preaching to the choir. But think about this …

Maybe YOU already know real estate is a powerful, predictable, and demonstrably more stable wealth-building vehicle than stocks over the long haul.

But paper asset investors have been riding an easy money wave up to record-levels … and now stock markets are starting to get REALLY jittery.

What once was a fun ride is now becoming scary. And if you’re a syndicator, this is MUSIC to your ears.

That’s because paper asset investors are probably looking at their brokerage accounts and retirement plans, and are growing much more open to getting involved in real estate when it’s presented properly.

And if you’re a Main Street real estate investor limited by only your own funds, maybe it’s time to consider leveraging your skills to get in on the syndication action.

We think syndication is arguably the best opportunity in real estate today.

We realize there are some people who think real estate might slow down because of rising interest rates. But history disagrees.

Rising rates just makes it hard for home buyers. And when it’s harder to buy, more people rent for longer, which is good for landlords.

Look what happened when the mortgage markets imploded in 2008 …

… no one could get a mortgage, millions had to rent, and even though there was a financial crisis … rents went up and up and up.

So all this stock market volatility is actually a gift to real estate investors.

Until next time … good investing!

More From The Real Estate Guys™…

- Sign up for The Real Estate Guys™ Free Newsletter and visit our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.