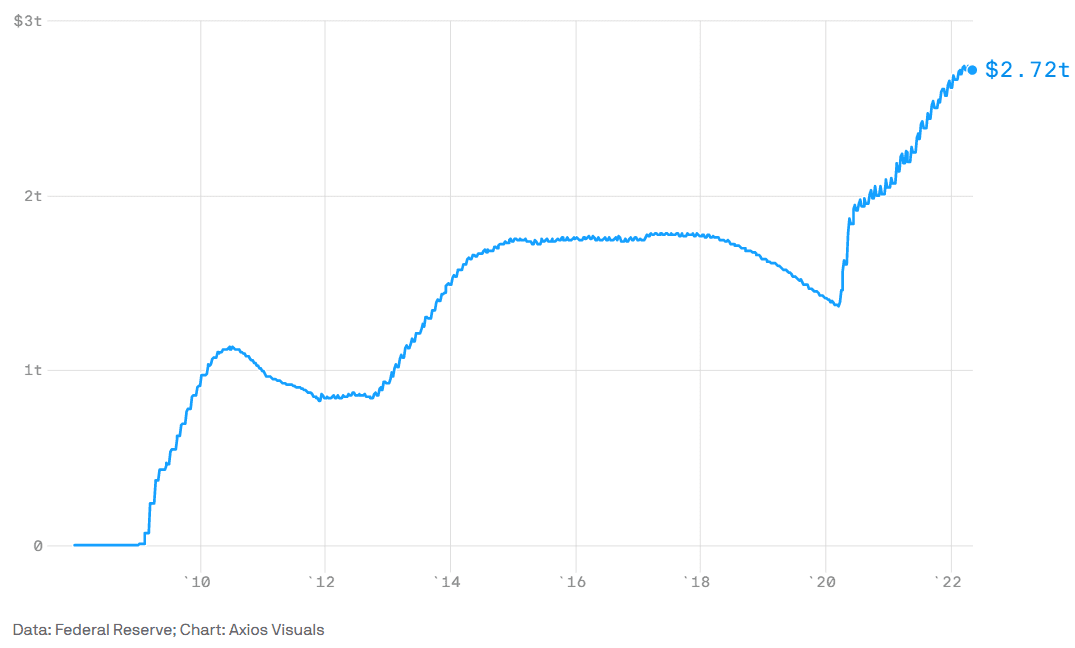

Fed holdings of mortgage-backed securities

Weekly; January 2, 2008, to May 11, 2022

If you took out a mortgage over the last couple of years, there’s a good chance the holder of that loan is America’s central bank — a consequence of its monetary stimulus efforts throughout the pandemic.

Why it matters: The Fed will face a series of political and economic headaches as it attempts to move away from subsidizing home lending by shrinking its portfolio of mortgage-backed securities.

- The problem: Extracting itself from this market risks crashing the housing industry and creating intense political blowback for incurring financial losses.

By the numbers: Back in February 2020, the Fed owned $1.4 trillion in mortgage-backed securities, and the number was falling rapidly. But when the pandemic took hold, the central bank began a new round of bond purchases (known as “quantitative easing”), swelling that number to $2.7 trillion.

- The policy contributed to ultra-low mortgage rates that stimulated home buying and refinancing activity until recently.

State of play: Now, as the Fed seeks to tighten monetary policy to combat inflation, it wants to shrink that portfolio. It may turn out to be easier said than done.

- The Fed says that by September it will reduce the mortgage portfolio by up to $35 billion per month. Emphasis on “up to.”

In fact, the numbers will probably undershoot that.

- The reason: For now, the Fed is just looking to let its holdings shrink as securities get paid off. But with mortgage rates way up in recent months, people have little incentive to sell their home or refinance a mortgage — so these mortgages are likely stay on the Fed’s books longer.

That will leave the Fed with unappealing options. It could simply accept that it will continue to have an outsized role in the housing market and a bigger balance sheet than it might prefer.

- Or it could begin selling the securities on the open market — a possibility that the minutes of its March policy meeting said could happen down the road.

What they’re saying: “Let’s get the program we’ve got underway and up to speed, but then once we’ve got it underway, I think it’ll be worth taking a look at what is happening to the mortgage-backed [securities] on our balance sheet,” Thomas Barkin, president of the Federal Reserve Bank of Richmond, tells Axios.

- “I’m certainly open to a targeted and disciplined way to sell into the market if we’re not headed toward the primarily Treasury balance sheet that we’ve said we want,” he said.

Yes, but: That will create its own problems. If the Fed sells mortgage securities that pay low rates at a time when prevailing rates are much higher, it will incur big financial losses that reduce the funds the central bank returns to the Treasury.

- In that scenario, expect officials to face tough questions from Capitol Hill to explain why they’ve lost billions of dollars on behalf of the American people.

- Plus, the selling would likely push mortgage rates up further, at a time the housing industry is already starting to groan under the pressure of rising rates. Homebuilders, real estate agents, and other influential industry groups will make their unhappiness known to elected officials.

The bottom line: The Fed’s pandemic actions fueled a housing boom. As it tries to withdraw that support, it could be bad news for housing — and the Fed’s standing on Capitol Hill.

More From The Real Estate Guys…

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!