The person who chases two rabbits catches neither …

Another week and a thousand sub-plots and angles to the COVID-19 story and how all this might affect real estate investors.

In a run-of-the-mill market gyration, those are usually fun and relevant rabbit-trails to go down. But there will be plenty of time for that later.

Sometimes it’s more important to stay focused on the main thing … even if it’s a little boring, redundant, or even (gasp!) political.

This is one of those times.

Think about it …

Virtually all major factors impacting the future of the economy, financial system, and currency that your portfolio and financial security depend on are being driven by policy.

Market participants like buyers, sellers, investors, tenants, and businesses all seem to be left out … or perhaps “locked down” is more accurate … of the process.

And the “gauges” most people focus on to determine the national, state, corporate, and individual health are questionable at best.

Whatever is going on right now is a far cry from “free” markets. It’s all driven by Federal Reserve and government (again, they’re not the same thing) policy.

So are we here to critique policy or rant about what “should” be?

Heaven forbid.

We’re not that smart … or brave. Besides, no one in charge is asking us what we think, so our opinions don’t count much in the real world anyway.

But with a thousand things to distract you, we’re simply pointing out that policy matters … and it’s a good idea to pay attention to policy so you can pivot to avoid problems and capitalize on opportunities.

As of this writing, we’re waiting to see what the Fed will say and do. They’re the makers of those important monetary policies which affect everyone everywhere.

For the uninitiated, the Federal Reserve is the issuer of U.S. dollars. The U.S. dollar currently serves as the reserve currency of the world.

Even though a lot of people know this … very few really understand it … and that’s a problem for both individuals and societies …

“By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

The Fed expands and contracts the amount of dollars in the system to directly or indirectly manipulate interest rates, inflation, asset prices … including stocks and real estate.

If you’re paying attention, you’re watching a hyper-active Fed operate in real-time.

The Fed underwrites the United States government’s debt and deficits … including all the stimulus spending, bailouts, and vote-buying handouts by both parties.

If you think of dollars like blood … a currency that flows through the body of the economy supplying nutrition to individual cells (people) and organs (organizations) …

… then it’s easier to understand the impact of the quantity, quality, and velocity of those dollars.

There are MANY issues at play in today’s world. But we think the dollar may well be the most important developing story.

Of course, long-time followers of The Real Estate Guys™ know we’ve been watching the dollar for quite some time.

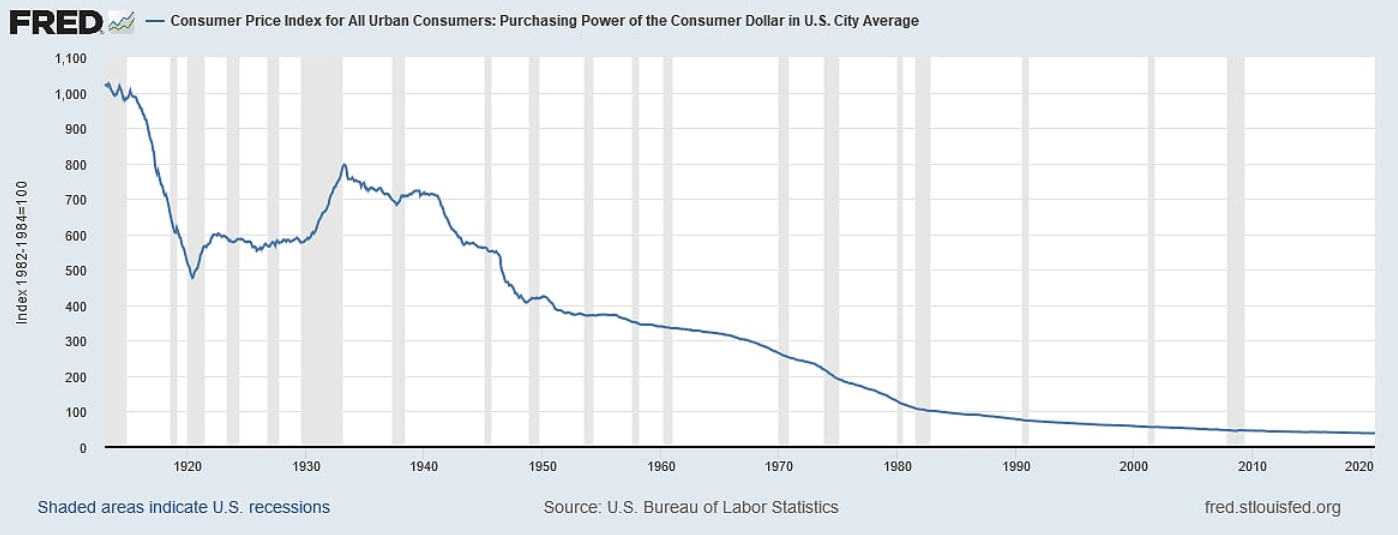

The long-term demise of the dollar is a mega-trend which began in 1913 …

SO much we could say about this one chart, but we’ll save it for future rants.

Profiting from the dollar’s persistent decline is the essence of leveraged real estate investing and the main thesis of Equity Happens.

Yes, we know we need to re-release Equity Happens. It’s on the to-do list. But it’s kind of flattering to see used copies trading for hundreds of dollars.

In fact, let’s use Equity Happens as a quick case study in inflation …

Right now, the supply of Equity Happens books is small. Apparently, the demand is high, so the price has been bid up.

(Note: We don’t get any of that premium. We wish. But it goes to the used booksellers. We’re still rummaging around the garage looking for copies so we can get in on the action.)

But the high price of Equity Happens isn’t the result of inflation. It’s the result of limited supply against relatively high demand. A copy of Equity Happens is rare.

Compare that to Rich Dad Poor Dad, the best-selling financial book in history.

At the same time Equity Happens is selling for over $400 per copy … nearly a 20x premium to the retail price …

… Rich Dad Poor Dad is selling for $5.39.

Does that mean Equity Happens is the better book? Or the demand for Equity Happens is higher than Rich Dad Poor Dad?

Not at all. In fact, far from it.

Now stick with us because this is the important lesson …

The disparity in price between Equity Happens and Rich Dad Poor Dad is a function of how many copies of Rich Dad Poor Dad have been printed.

While we only printed less than 100,000 copies of Equity Happens … untold millions of copies of Rich Dad Poor Dad are in the marketplace.

As a product, abundant supply is fantastic for the consumer. Mass production creates abundant supply which produces low prices and allows more people to acquire the book.

In other words, falling prices are a boon to consumers. It expands the ranks of the “haves”. Cheaper books mean more people can afford them. Remember this when some official tells you deflation is a threat. It is … but not to you.

What if Rich Dad Poor Dad wasn’t a book, but a currency that you were earning and saving … how’s it working now?

Let’s say you went into the market and traded the blood, sweat, and tears of your labor for 100 copies of Rich Dad Poor Dad at a time when the book sold for $12.

Then suppose Robert Kiyosaki prints another 10 million copies because his printing cost is only pennies per book.

This printing increases supply and drives the book price down from $12 to less than $6.

Yes, more people get copies of Rich Dad Poor Dad. In fact, maybe Kiyosaki deposits books directly into the libraries of readers everywhere.

But you … you worked for your copies at a time when the value of your work was based on a price of $12 per copy.

And you saved your copies in your library so you could trade them later for other books you’d like to read. But now, your copies are worth half as much.

You lose. The act of printing more books diluted the value of the books you already earned.

Now, go back and re-read the story of Equity Happens and Rich Dad Poor Dad … but replace Equity Happens with gold, Rich Dad Poor Dad with dollars, and Robert Kiyosaki with the Federal Reserve.

Monetary policy … the printing of dollars … affects you and EVERYONE earning, borrowing, saving, and investing in dollars.

And just in case you didn’t hear, the Fed is printing TRILLIONS of them … more and faster than at any other time in history.

There are a LOT of angles to the cascading crisis created by COVID-19, so it’s easy to take your eye off the main thing. We could be wrong, but we think the main thing is the dollar.

Unfortunately, most Americans and the pundits who inform them aren’t really talking about the dollar. So we are … and have been for years and years.

Today, everything is moving bigger and faster. Extreme policies are likely to produce extreme results.

Whether those extreme results harm or benefit you and your portfolio depends on how aware, prepared, and responsive YOU are.

But your results also depend on what everyone else in the eco-system does … and the policies they support. So talk with your family and friends. Encourage them to pay attention too.

Spreading financial awareness and preparedness helps flatten the curve of economic impact to the financial system.

Like COVID-19, bad ideas are highly infectious … especially when people are highly vulnerable. Ideas affect individual actions and institutional policies.

We’re not telling you what to think or do.

But if you’ve been hitting the snooze button up to now, it’s probably time to snap to attention and start studying. Think and do is better than wait and see.

There’s a lot more to this chain of events to come.

Thanks to all of you who’ve taken the time to send a little sunshine our way. It means a lot to us!

Here’s what The Real Estate Guys™ Radio Show community is saying …

“Awesome analogy for gold, dollar, and the Fed! … ” – John Y., 6/10/2020